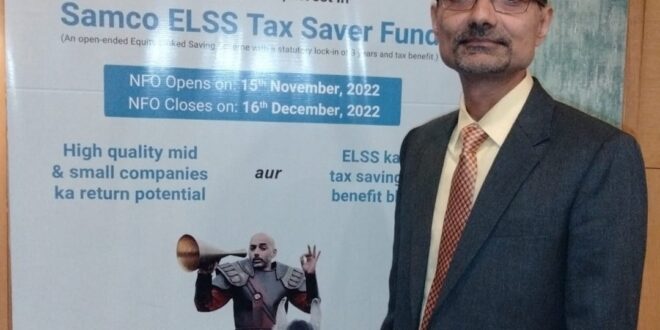

Chennai, November 2022: Samco ELSS Tax Saver Fund will be a portfolio of efficient Mid-Cap and Small-Cap businesses with a mandatory 3-year lock-in period in an ELSS as a classic way for wealth creation.

To help investors invest in fundamentally strong businesses which have a higher potential of becoming the wealth creators of tomorrow, Samco ELSS Tax Saver Fund makes use of the HexaShield Framework, a proprietary strategy driven by technology, to filter out an investible universe of high-quality efficient stocks. The Fund Management Team analyses companies from this investible universe to construct a portfolio of growth-oriented businesses with high adjusted return on capital employed.

On a 3-year average rolling returns basis, the Nifty MidSmallCap 400 index has returned 8% higher returns compared to the Nifty500 index since April 1, 2005, (Disclaimer: past performance may or may not sustain in future. Please note that these are returns of an Index and not of any particular scheme). The volatility around holding Mid-Cap and Small-Cap businesses also smoothens out significantly in the 3-year time horizon compared to a 1-year holding period. Hence, an investor can generate higher risk-adjusted returns by investing in such a fund that has exposure to Mid-Cap and Small-Cap businesses by mandatorily holding the portfolio for at least 3-years.

There is a myth in the industry that generally Mid-Caps and Small-Caps are poor-quality businesses just because of their size. In reality and on the contrary some of these businesses are leaders in their respective categories, having robust earnings growth, high stickability, strong intangibles, and high pricing power despite their smaller size. It is essential to understand the traits of businesses to invest in the right ones which can become giants of tomorrow because a Mid-Cap stock in its life faces two outcomes – a mid-Cap could become a Small-Cap i.e. Wealth Destructor, or a Mid-Cap could become a Large-Cap i.e. Wealth Creator.

Expressnews

Expressnews