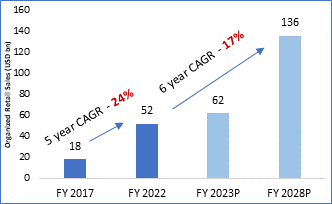

Mumbai, 13th September 2022: Knight Frank India, leading international property consultant in the country, in its latest report‘Think India, Think Retail 2022 – Reinventing Indian ShoppingMalls’ cited that the organised retail sales volume in the top 8 Indian cities is estimated to grow at a CAGR of 17%, from USD 52 billion (bn) in FY 2022 to USD 136 bn by FY 2028. In the same period, potential retail sales in Indian malls are estimated to grow at a CAGR of 29% in the FY 2022 – 28 period reaching USD 39 bn by FY 2028. Retail sales in Indian malls across the top 8 cities grew at a CAGR of approximately 3% to reach USD 8 bn in FY 2022 while in FY 2023, the potential consumption is estimated to surpass the pre – COVID-19 levels to reach USD 11 bn. The organised retail sales volume will grow at an expected CAGR of 24% between FY 2017 and FY 2022 maintaining a healthy rate of growth despite the pandemic induced slowdown.

FORECAST OF ORGANIZED RETAIL SALES VOLUME FORECAST OF POTENTIALCONSUMPTION IN

MALLSACROSS TOP 8 MARKETS*

Source: Knight Frank Research; Note: FY 2023P, FY 2028P denotes the projected size by FY 2023, FY 2028

*Denotes operational as well as upcoming supply in markets under consideration

Sharing an overview on the ‘Mall Culture’ in India, Shishir Baijal, Chairman & Managing Director at Knight Frank India said, “The retail real estate sector has reached a new level of maturity where smaller sized and lower grade developments are giving way to Grade A malls. The existing Grade A malls have over 95% occupancy which is indicative of the demand for quality real estate in this segment. Given that retail malls are experiential, more of the future developments will want to create destinations. Therefore, scale and quality of development would require developers to specialise in shopping centre development and operations. Like the office segment, post consolidation, retail real estate too will offer great opportunity for investments including REITs in the future.”

At the end of H1 2022 period, the retailer category split in mallspresents a similar picture compared to pre-Covid times. Apparels and accessories are the two categories that have expanded their footprints. From 26% share of apparels has increased to 29% in malls. Accessories such as books, watches, jewellery, eyewear, and others witnessed a prominent increase from 8% in pre-Covid to 12% in space take-up in malls. Beauty, Footwear and Entertainment categories also registered a marginal growth in category split during the same period. Other categories which include gymnasium and other miscellaneous categories were the worst hit and recorded a gradual decrease from 21% in pre-Covid to 12% in the post-Covid period.

RETAILER CATEGORY SPLIT COMPARISON

Source: Knight Frank Research

Recovery in Consumption – Region Wise & Category Wise Sales Growth Index

Eastern and northern regions of India witnessed a strong recovery in consumption reaching new heights by crossing pre-pandemic levels in March 2022. The Eastern region registered a significant increase in index value from 100 (as a base index as of March 2019) to an index value of 123 at the end of March 2022. The consumption index in the northern region increased to 118 during the same period. The southern region registered a steady improvement in recovery crossing pre-pandemic levels registering an index value of 108 whereas the western region took the worst hit due to tighter restrictions and consumption was marginally less than pre-pandemic levels (index value of 99) at the end of March 2022.

REGION WISE SALES GROWTH TRENDS

Source: Knight Frank Research, RAI Notes: Index base value of 100 in March-2019

Expressnews

Expressnews